Servers

Tax Year 2023 Tax Software APIs

For tax year 2023

-

We (ITIPS) will interface with tax software client applications using both

- Open Financial Exchange (OFX) standard and

- Financial Data Exchange (FDX) standard (REST)

- We will make use of an API gateway

- Access to the API endpoints will require a knowledge of the gateway URL(s)

- Access to the API endpoints will require use of an assigned API key

- The gateway URL(s) and API key information will be available at our developer portal

-

Tax data will originate from 3 of our websites:

- Form8949.com

- ScheduleK-1.com

- TaxDocHub.com

For the convenience of tax software companies not able to make the changes described here, we will continue to operate our legacy OFX server at the same URL(s) as before.

1. Form8949.com

Users of Form8949.com assemble and perfect their capital gain and loss information before importing into tax software.

Our app hosts the data for import into tax software.

Data is imported based on "document credentials", Tax Document ID and Passcode

The corresponding tax software import screens are seen below.

We propose some adjustments to the screens for tax year 2023 as seen below.

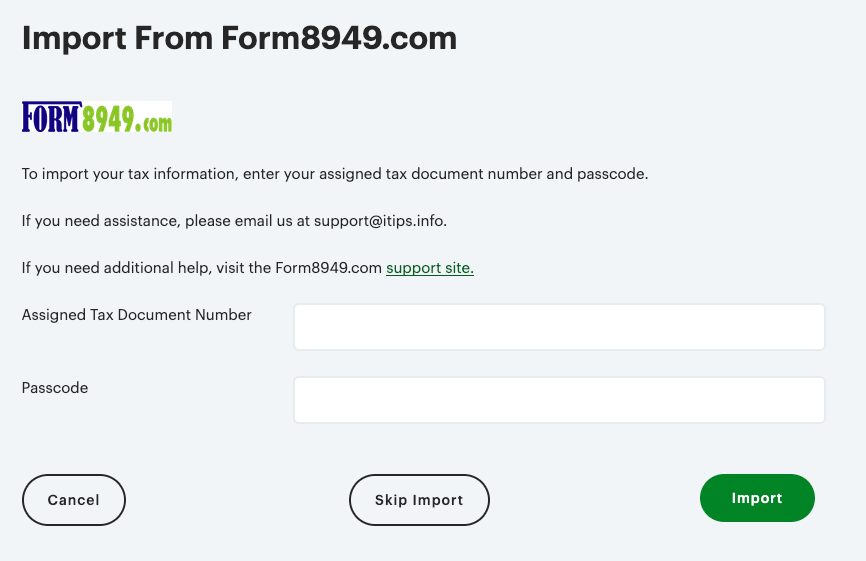

H&R Block User Interface

Existing

Requested 2023 Adjustments

Import From Form89849.com

![]()

To import your tax information, enter your assigned tax document ID and passcode.

If you need assistance, please email us at support@form8949.com.

If you need additional help, visit the Form8949.com support site.

Assigned Tax Document ID

Passcode

Changes

- We need to get you a logo with transparent background

- Change 'number' to 'ID'

- Change support email to support@form8949.com

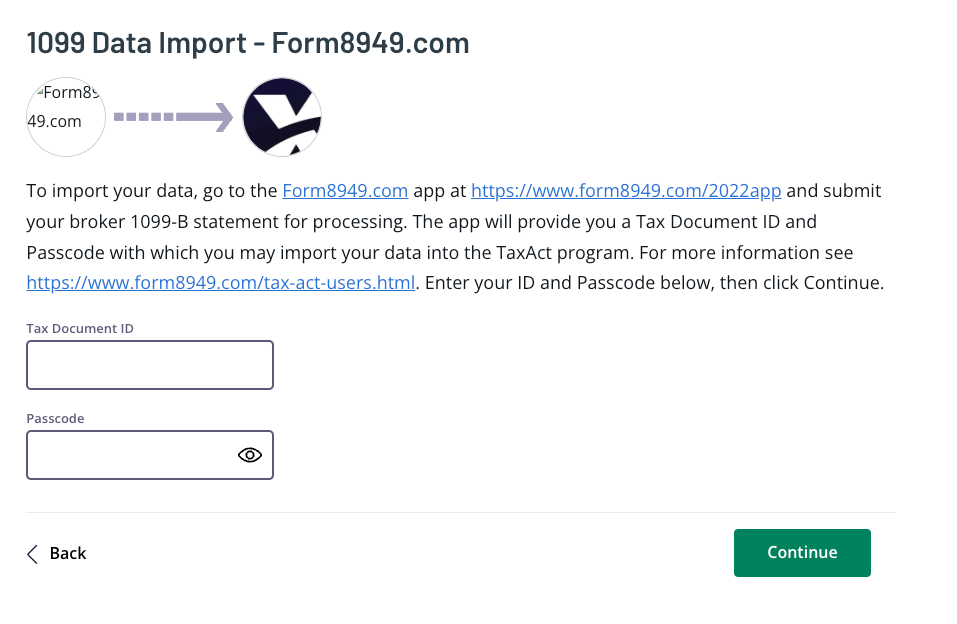

TaxAct User Interface

Existing

Requested 2023 Adjustments

1099 Data Import - Form8949.com

IMAGE

To import your data, go to the Form8949.com app at https://www.form8949.com/app and submit your broker 1099-B statement for processing. The app will provide you a Tax Document ID and Passcode with which you may import your data into the TaxAct program. For more information, see https://www.form8949.com/tax-act-users.html. Enter your ID and Passcode below, then click Continue.

Changes

- We will supply a square logo file for you to apply the circle and sizing as required

- Change app URL as seen. Going forward, the app URL will not have a year component.

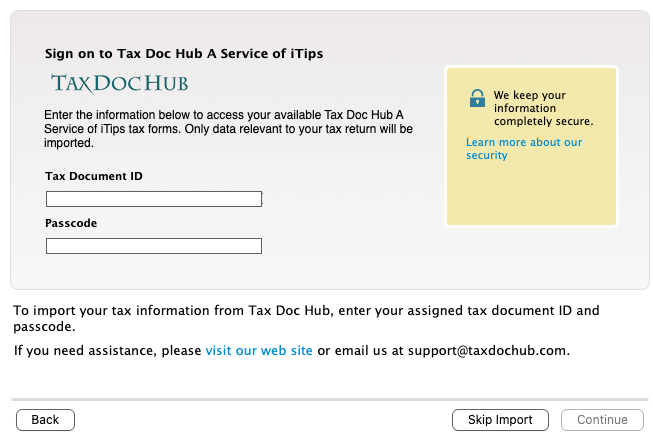

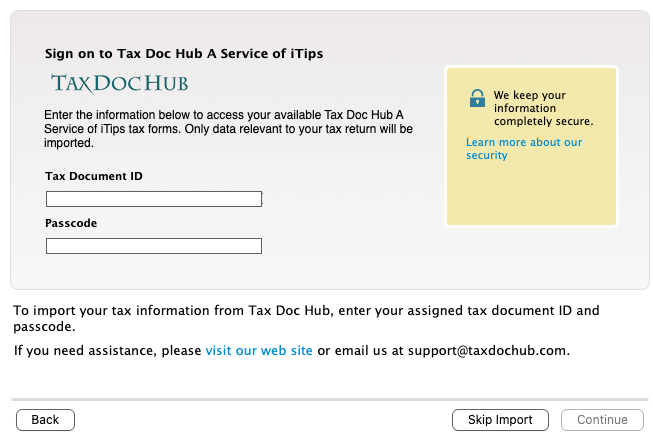

TurboTax User Interface

Existing

Requested 2023 Adjustments

Sign on to Form8949.com A Service of ITIPS

![]()

Enter the information below to access your available Form8949.com A Service of ITIPS tax forms. Only data relevant to your tax return will be imported.

Changes

- Use Form8949.com brand in this context.

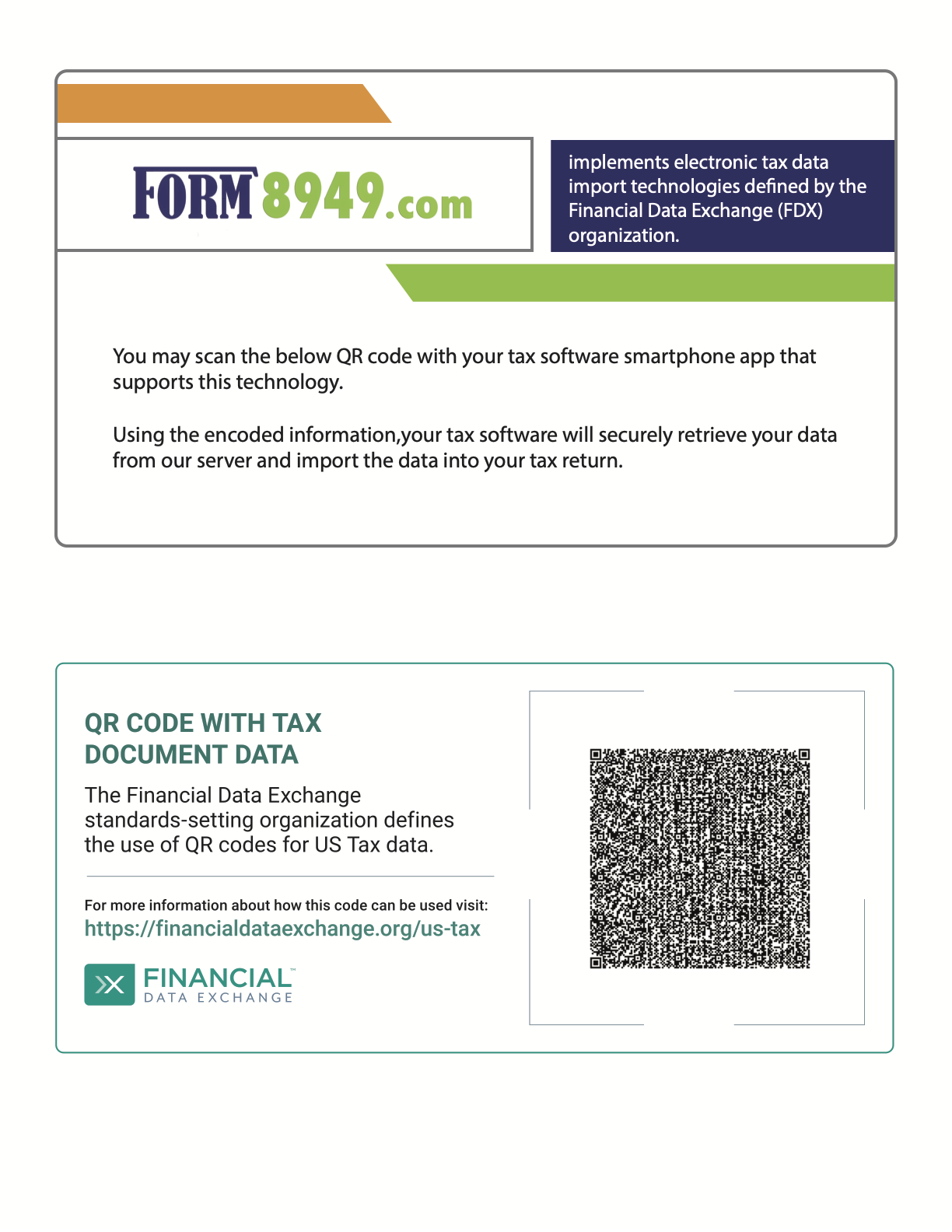

QR Code

As seen in the example below, users receive a QR Code which is intended to be snapped by tax software smartphone apps. The tax software imports the data referenced in the code.

QR Code Content

Here is an example:

{

"tax1099B": {

"taxFormId": "714870003",

"taxFormType": "Tax1099B",

"attributes": [

{

"name": "BasicAuthPart1",

"value": "714870003"

},

{

"name": "BasicAuthPart2",

"value": "123456"

}

],

"links": [

{

"href": "https://${API_DOMAIN_FORM8949DOTCOM}/form-8949-data",

"action": "GET",

"rel": "Form8949Data",

"types": [

"application/json"

]

},

{

"href": "https://${API_DOMAIN_FORM8949DOTCOM}/form-8949-exception-2-statement",

"action": "GET",

"rel": "Form8949Exception2Statement",

"types": [

"application/pdf"

]

}

],

"securityDetails": [

{

"checkboxOnForm8949": "A",

"saleDescription": "See statement attached to Form 1040 or Form 8453",

"variousDatesAcquired": true,

"dateOfSale": "2022-12-31",

"salesPrice": 331399.32,

"adjustmentCodes": [

{

"code": "M"

}

],

"costBasis": 255774.38,

"washSaleLossDisallowed": 17668.1

},

{

"checkboxOnForm8949": "B",

"saleDescription": "See statement attached to Form 1040 or Form 8453",

"variousDatesAcquired": true,

"dateOfSale": "2022-12-31",

"salesPrice": 64568.23,

"adjustmentCodes": [

{

"code": "M"

}

],

"costBasis": 63109.93

},

{

"checkboxOnForm8949": "D",

"saleDescription": "See statement attached to Form 1040 or Form 8453",

"variousDatesAcquired": true,

"dateOfSale": "2022-12-31",

"salesPrice": 4750.21,

"adjustmentCodes": [

{

"code": "M"

}

],

"costBasis": 15786.21

}

]

},

"version": "V5.0",

"softwareId": "Form8949.com"

}

QR Code Content Explanation

The code contains:

- Summary transaction data. See "securityDetails".

- Import codes. See "attributes".

-

Import links.

See "links".

- The first link is to import detail data.

- The second link is to import a PDF to be attached to the return.

Server Endpoint for OFX

https://{GATEWAY_URL}/8949/ofx

Server Endpoint for FDX

https://{GATEWAY_URL}/8949/fdx/v5/tax-forms

2. ScheduleK-1.com

For tax year 2023, we are reactivating our application at www.schedulek-1.com.

Partnerships submit their MeF XML files including K-1 data to our service, our app assigns unique IDs to each K-1 and hosts the data for import into tax software.

Additionally, individual partners who receive K-1 data in TXF format from sites such as taxpackagesupport.com may submit their TXF file for conversion and import hosting.

User Interface

Ideally, online tax software applications would establish (or reestablish) generic import capabilities. This is analogous to the "File > Import > From Financial Institutions" feature of desktop applications. Doing so would allow for import of the many tax documents for which an integrated interview experience is not yet available. Please let us know if this is already available and we are not aware.

Import From ScheduleK-1.com

![]()

To import your tax information, enter your assigned tax document ID and passcode.

If you need assistance, email us at support@schedulek-1.com.

Tax Document ID

Passcode

QR Code

QR Code Content

Here is an example:

{

"tax1065K1": {

"description": "Too much data for QR encoding. Document ID and Code provided for import.",

"attributes": [

{

"name": "BasicAuthPart1",

"value": "123456489498451561"

},

{

"name": "BasicAuthPart2",

"value": "123215"

}

]

},

"version": "V5.0",

"softwareId": "TaxDocHub"

}

QR Code Content Explanation

The code contains:

- Import codes. See "attributes".

Server Endpoint for OFX

https://{GATEWAY_URL}/hub/ofx

Server Endpoint for FDX

https://{GATEWAY_URL}/hub/fdx/v5/tax-forms

3. TaxDocHub.com

Small businesses submit tax document data (e.g. 1099s) to our Intelligent Tax Document™ Generator app.

- We generate PDF tax documents, e-file to IRS, and host the tax data for import.

Additionally, individuals scan tax documents with QR codes with the Tax Doc Hub smartphone app.

- We assign tax document IDs and host the tax data for import.

User Interface

Existing

Requested 2023 Adjustments

None Needed

Server Endpoint for OFX

https://{GATEWAY_URL}/hub/ofx

Server Endpoint for FDX

https://{GATEWAY_URL}/hub/fdx/v5/tax-forms