API to Submit Tax Documents for Import

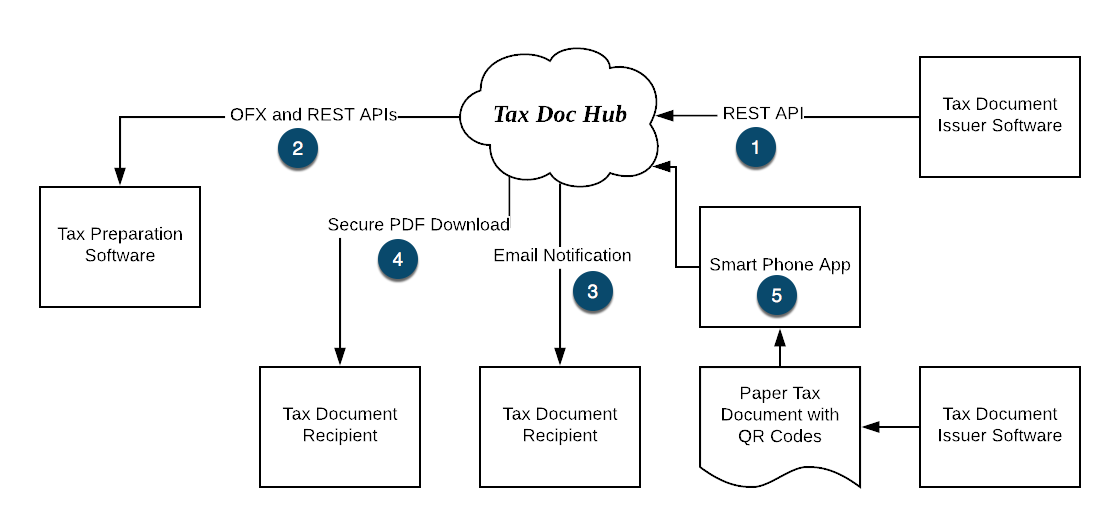

As seen at item #1 in the diagram below, by using the API services of Tax Doc Hub, you can make your tax documents importable into tax software applications without hosting your own server.

First obtain an API key then follow these steps:

- Collect your document data from your database or file system

- Create TaxStatement object

- Serialize to JSON

- POST the data as shown below

- Receive response with assigned tax document ID and document code

- Extract assigned tax document ID and document code and supply to document recipients

- Users can import document data into tax software using these 2 items of data

SDK to instantiate and serialize TaxStatement objects are available at SDK Information

HTTP Request

Method

POST

URL

https://available-after-subscription/fdx/v6/tax-forms

Request headers

Accept: application/json

Content-Type: application/json

x-apikey: {your-api-key}

Example post body

{

"forms" : [ {

"tax3922" : {

"taxYear" : 2025,

"accountId" : "94-326-6005",

"taxFormId" : "6567695",

"taxFormDate" : "2025-12-31",

"issuer" : {

"tin" : "00-0256293",

"partyType" : "BUSINESS",

"businessName" : {

"name1" : "Streich, DuBuque and Glover"

},

"address" : {

"line1" : "05919 Jessie Squares",

"city" : "Irwinville",

"region" : "TX",

"postalCode" : "56898"

},

"phone" : {

"number" : "555-867-5309"

},

"email" : "bret.mcglynn@gmail.com"

},

"recipient" : {

"tin" : "000-82-1334",

"partyType" : "INDIVIDUAL",

"individualName" : {

"first" : "Mandi",

"last" : "Gleichner"

},

"address" : {

"line1" : "962 Walter Crossroad",

"city" : "Ortizside",

"region" : "IN",

"postalCode" : "88211"

},

"email" : "issac.jones@gmail.com"

},

"attributes" : [ ],

"links" : [ ],

"accountNumber" : "130-00631-6",

"optionGrantDate" : "2025-04-25",

"optionExerciseDate" : "2025-10-08",

"grantMarketValue" : 200,

"exerciseMarketValue" : 300,

"exercisePrice" : 400,

"numberOfShares" : 500,

"titleTransferDate" : "2025-07-18",

"grantDateExercisePrice" : 600

}

} ],

"attributes" : [ ]

}

HTTP Response

Example Response Header

Note:

The assigned tax document ID is shown in the 'x-taxdochub-document' header.

The assigned document code is included in the 'x-taxdochub-passcode' header.

HTTP/1.1 200 OK content-type: application/json vary: Accept-Encoding vary: Origin vary: Access-Control-Request-Method vary: Access-Control-Request-Headers x-taxdochub-document: 6328696071782400 x-taxdochub-passcode: 21098753 content-encoding: gzip x-cloud-trace-context: 191df29ed5563a53de63128682686a87;o=1 date: Tue, 27 Jan 2026 01:02:26 GMT server: Google Frontend transfer-encoding: chunked

Example Response Body

{

"taxStatementId": "6328696071782400",

"forms": [

{

"tax3922": {

"taxYear": 2025,

"accountId": "94-326-6005",

"taxFormId": "6567695",

"taxFormDate": "2025-12-31",

"issuer": {

"tin": "00-0256293",

"partyType": "BUSINESS",

"businessName": {

"name1": "Streich, DuBuque and Glover"

},

"address": {

"line1": "05919 Jessie Squares",

"city": "Irwinville",

"region": "TX",

"postalCode": "56898"

},

"phone": {

"number": "555-867-5309"

},

"email": "bret.mcglynn@gmail.com"

},

"recipient": {

"tin": "000-82-1334",

"partyType": "INDIVIDUAL",

"individualName": {

"first": "Mandi",

"last": "Gleichner"

},

"address": {

"line1": "962 Walter Crossroad",

"city": "Ortizside",

"region": "IN",

"postalCode": "88211"

},

"email": "issac.jones@gmail.com"

},

"attributes": [],

"links": [],

"accountNumber": "130-00631-6",

"optionGrantDate": "2025-04-25",

"optionExerciseDate": "2025-10-08",

"grantMarketValue": 200,

"exerciseMarketValue": 300,

"exercisePrice": 400,

"numberOfShares": 500,

"titleTransferDate": "2025-07-18",

"grantDateExercisePrice": 600

}

}

],

"attributes": []

}