OUR GOAL

Simplify and streamline

the income tax return

preparation experience

of taxpayers and their tax preparers

in a

tax-software-agnostic

way.

To achieve this goal

we are developing

a new system that includes

Application Program Interfaces

Docker Images, and

for use by

The "Why" of Tax Doc Hub

The system is based on the following premises:

-

MANUAL DATA ENTRY IS TEDIOUS, ERROR-PRONE, AND UNNECESSARY

It makes no sense for issuers of tax information documents to have data in electronic form -- only to print it to paper and require manual data entry by taxpayers or tax preparers to get the data back into electronic form in tax software. Manual data entry should be replaced with one or more of the following:- API

- Industry standard file export/import

- QR code scan

-

WHEN SCANNING PRINTED TAX FORMS: QR IS BETTER THAN OCR

Some use optical character recognition (OCR) software to get printed tax form data into tax software. We believe that OCR software is too costly and is not sufficiently reliable. A better technology for this purpose is two-dimensional bar codes such as QR codes. -

WHEN DOWNLOADING TAX FORMS FROM A WEBSITE: Industry-standard files are better than generic PDF

"Paperless" delivery of tax information documents in Portable Document Format (PDF) via email and web download speeds delivery and saves paper. But PDF can still require manual data entry. Issuers should make document data downloadable in a standard digital format. And tax software should accept digital data files via "drag and drop". Additionally, the older Tax Exchange Format (TXF) should be replaced with a modern, well-supported, standard. -

DIRECT ELECTRONIC IMPORT INTO TAX SOFTWARE VIA API SHOULD BE EXPANDED AND IMPROVED

Use of Open Financial Exchange (OFX) server technology makes end-to-end electronic delivery of tax data possible.

However:- Medium and smaller sized companies shouldn't have to incur the cost and headache of developing and operating their own OFX server.

- More tax information documents (especially Schedules K-1 and other documents with multiple data items) should be commonly importable by tax software programs.

- The credentials used to retrieve tax documents should not be the same as those to log on to a financial instituion web site.

- Ideally, tax software users should not have to authorize the application to retrieve their tax document data each year. An "until-revoked" authorization should be available.

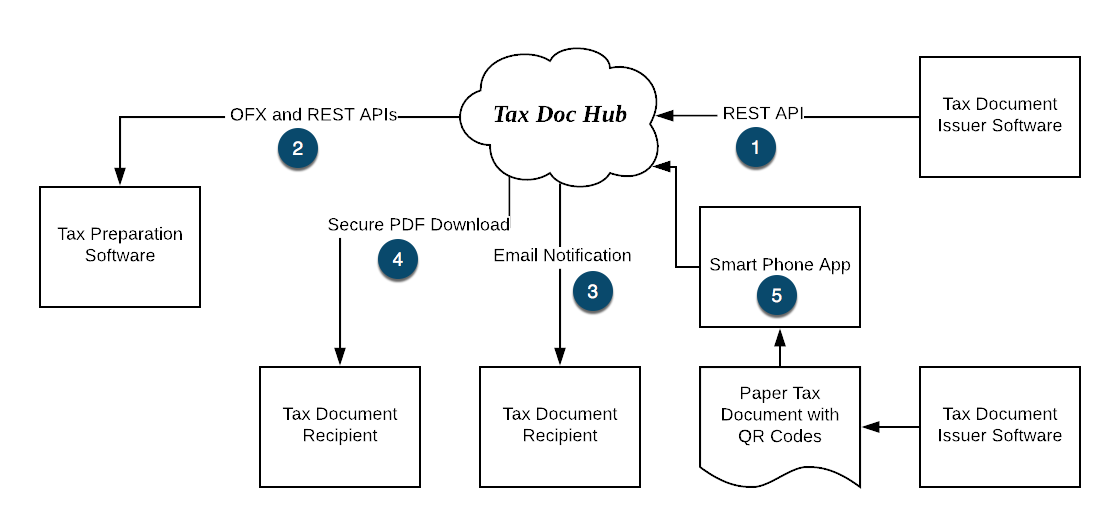

The "What" of Tax Doc Hub

Our system will have the following elements:

- Application Program Interfaces (APIs) which can be used by tax document issuing software to:

- generate PDF,

- electronically deliver, and/or

- allow tax software import of data.

- APIs which can be used by tax preparation software to import over 50 types of tax information document data into their program. (Both OFX and REST APIs.)

- Email notifications to recipients of availability of tax information documents.

- Secure web download of tax information documents by recipients.

- Smart phone apps to scan QR codes and make data available for import into tax software.

Documents for Import into

Tax Software (1040) Programs

Tax preparation (1040) software may now import over 50 types of tax information document data into their program.

- Business Income Statement : Business Income Statement for IRS Form 1040 Schedule C

- Farm Income Statement : Farm Income Statement for IRS Form 1040 Schedule F

- Farm Rental Income Statement : Farm Rental Income Statement for IRS Form 4835

- Rental Income Statement : Rental Income Statement for IRS Form 1040 Schedule E

- Royalty Income Statement : Royalty Income Statement for IRS Form 1040 Schedule E

- 1041-K-1 : Beneficiary's Share of Income, Deductions, Credits, etc.

- 1042-S : Foreign Person's U.S. Source Income Subject to Withholding

- 1065-K-1 : Partner's Share of Income, Deductions, Credits, etc.

- 1095-A : Health Insurance Marketplace Statement

- 1095-B : Health Coverage

- 1095-C : Employer-Provided Health Insurance Offer and Coverage

- 1097-BTC : Bond Tax Credit

- 1098 : Mortgage Interest Statement

- 1098-C : Contributions of Motor Vehicles, Boats, and Airplanes

- 1098-E : Student Loan Interest Statement

- 1098-MA : Mortgage Assistance Payments

- 1098-Q : Qualifying Longevity Annuity Contract Information

- 1098-T : Tuition Statement

- 1099-A : Acquisition or Abandonment of Secured Property

- 1099-B : Proceeds From Broker and Barter Exchange Transactions

- 1099-C : Cancellation of Debt

- 1099-CAP : Changes in Corporate Control and Capital Structure

- 1099-DIV : Dividends and Distributions

- 1099-G : Certain Government Payments

- 1099-H : Health Coverage Tax Credit (HCTC) Advance Payments

- 1099-INT : Interest Income

- 1099-K : Merchant Card and Third-Party Network Payments

- 1099-LS : Reportable Life Insurance Sale

- 1099-LTC : Long-Term Care and Accelerated Death Benefits

- 1099-MISC : Miscellaneous Income

- 1099-NEC : Nonemployee Compensation

- 1099-OID : Original Issue Discount

- 1099-PATR : Taxable Distributions Received From Cooperatives

- 1099-Q : Payments From Qualified Education Programs

- 1099-QA : Distributions From ABLE Accounts

- 1099-R : Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

- 1099-S : Proceeds From Real Estate Transactions

- 1099-SA : Distributions From an HSA, Archer MSA, or Medicare Advantage MSA

- 1099-SB : Seller's Investment in Life Insurance Contract

- 1120S-K-1 : Shareholder's Share of Income, Deductions, Credits, etc.

- 2439 : Notice to Shareholder of Undistributed Long-Term Capital Gains

- 3921 : Exercise of an Incentive Stock Option Under Section 422(b)

- 3922 : Transfer of Stock Acquired Through an Employee Stock Purchase Plan under Section 423(c)

- 5227-K-1 : Split-Interest Trust Beneficiary's schedule K-1

- 5498 : IRA Contribution Information

- 5498-ESA : Coverdell ESA Contribution Information

- 5498-QA : ABLE Account Contribution Information

- 5498-SA : HSA, Archer MSA, or Medicare Advantage MSA Information

- W-2 : Wage and Tax Statement

- W-2c : IRS form W-2c, Corrected Wage and Tax Statement

- W-2G : Certain Gambling Winnings

Electronically deliver your company's 1098, 1099, and W-2 forms

Notify recipients of secure download availability via email

Recipients may opt in to secure web download of tax information documents in PDF format.

Participating Tax Software programs include:

- H&R Block

- TaxAct

- Intuit TurboTax

Make your company's 1098, 1099, and W-2 forms importable into Tax Software

without

hosting your own

API server

Options:

- Individual document data submission to our API

- Bulk data upload

Scan Tax Document Data in QR Format

Smart phone apps to scan tax document QR codes and make data available for import into tax software.

If Your Company is a Financial Data Aggregator

As a small company, we can do only so much by ourselves.

If you believe in the concepts and features described above,

consider teaming with us via merger, acquisition, or

joint venture

.

Email us at

info@taxdochub.com

to discuss the possibilities.